Current Market Outlook

BLOG POST: Our Current Market Outlook is “Uptrend Under Pressure” and our light is “yellow.“

The market continues to be under a 2nd stage SELL signal (2nd of a possible 3) and is exhibiting increasing signs of internal broad market deterioration. The risk level in the market has increased significantly as historical technical-measurements of the markets overall health are sending serious warning signs. We stand on the verge of changing our official Current Market Outlook to a “Red” light. The price & volume action in the major indexes this coming week will determine our next step.

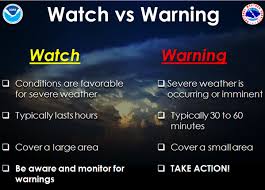

Growing up in central Illinois in “Tornado alley” taught me to respect changes in current conditions and to expect the unexpected when certain conditions existed. This literally saved my family’s life one night back in the 70’s. We learned that night there was an important difference between a tornado watch & a tornado warning. In matters of severe weather, often times “watches” grow into warnings. The same is true in the stock market. We are currently under a “watch” for a looming market correction.

Storm clouds are building in the stock market. Conditions are changing, important conditions, such as mounting Distribution Days, expanding new 52 week lows, & the direction of interest rates.

A famous saying on Wall Street is “don’t fight the Fed”. It means don’t go against the Federal Reserve Board when they change their policy from easy money to tighter money. It became a famous saying because when adhered to it kept investors out of harms way. John Maynard Keynes once said, “When the facts change, I change my mind. What do you do, sir?” As we see it, the facts are beginning to change, and so is our Outlook getting close to a change. Just a little more evidence is required.

Jesse Livermore said “There is only one side of the market and it is not the bull side or the bear side, but the right side.” We agree. We exert a great deal of effort daily at TPM to make sure we achieve our dual mandate for our clients; growing their capital in up-trending markets while preserving it in down-trending or bear markets. While we have not had an official all out SELL signal, one may be just days or weeks away. The battle between the bulls & the bears is raging and there is not a clear victor yet. The markets could even rally in the next week or two as the buy the dip crowd follows their plan. But until certain internal technical-conditions change (actual daily readings of numbers reflecting the footprints of money) this market is growing sicker by the day and is more likely to head lower than to soar and stay at new highs again soon. We remain on the defensive and are managing our clients assets accordingly.

Have a Triumphant day! ®

The information in this article is based on data obtained from recognized services and sources and is believed to be reliable. Any opinions, projections or recommendations in this report are subject to change without notice and are not intended as individual investment advice. Not to be used as legal or tax advice.

©2017 Triumphant Portfolio Management, LLC.

The Latest

BLOG POST: Our Current Market Outlook is “Uptrend Under Pressure” and our light is “yellow.“

Where Are Woodward and Bernstein When We Need Them? This article was written by Newt

A poem about a modern day Pig in a Poke, being “woke” and going broke.

Triumphant Truth

You’re not here by accident. God loves you. He wants you to have a personal relationship with Him through Jesus, His Son. Triumphant strives to honor the Lord and bear witness to His love and mercy by serving our clients with disciplined, proactive wealth management.

14803 Forest Rd.

#1147

Forest, VA 24551

Request a Triumphant newsletter to receive updates on the markets and Christ-centered investing.

Send mail to:

14803 Forest Rd. # 1147

Forest, VA 24551

Request a Triumphant Newsletter to receive updates on the markets and Christ-centered investing.

This information is not intended to be a substitute for specific individualized advice. The TPM strategies cannot assure a profit nor protect against loss. Inherent limitations and market conditions may affect the performance of portfolios in any given market environment. Past performance does not guarantee future results. Investors should consider the investment objectives, risks, charges, and expenses associated with any investment strategy.

Advisory Services Through Sowell Management, a Registered Investment Advisor | Privacy & Disclosures | © 2025 Triumphant Portfolio Management, LLC