Current Market Outlook

BLOG POST: Our Current Market Outlook is “Market in a Correction” and our light is “red.“

The stock market’s oversold condition is likely to usher in a bounce in the coming days. Friday’s big price reversal (although on lower volume vs. the prior day) kicked it off heading into the last day of the month/first day of the month in-flows combination today and tomorrow.

At today’s open (SPX @ 4,431.79), our Current Market Outlook was upgraded to “Uptrend Under Pressure” with a yellow light. Our “Core Four” had 2 red, 1 yellow and 1 green light at Friday’s close (see top of page). The current environment for investing in growth stocks and the general stock market indexes displays an uncertain future direction. It seems that this remains a high-risk market in which the bears are on the prowl.

The stock market is attempting its first rally since the Fed’s announcement of its accelerated rate hike intention. While our C.M.O. signal has been upgraded to yellow, the odds are high that this first rally attempt will fail and more time will be needed to put in a bottom.

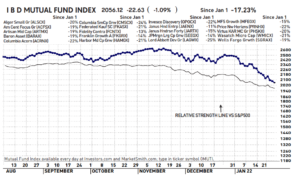

The price damage suffered in several sectors over the past few weeks has been significant. This type of damage takes time to repair. For example, as of Thursday’s close last week, the S&P500 had fallen 439.67 points or 9.22%, and the Nasdaq tumbled 2,292.19 points or 14.65%. Many leading mutual fund managers suffered even larger losses since January 1st, as seen on this IBD graphic.

(Source: Investor’s Business Daily 01/27/2022, General Market Indicators page)

What to do now? Expect volatility to stay elevated. Stay calm and employ patience. We repeat: The markets tailwind (low rates and plenty of new stimulus) has now flipped to a headwind (higher rates and an end to frivolous stimulus). The market can not go up decisively from here unless it moves back above its 50-day mav and then holds above it for several days. It may take longer for the market to heal this time. Stay focused on the yield of the US 10-year note for a close over 2% as a market tell.

Have a Triumphant day! ®

The information in this article is based on data obtained from recognized services and sources and is believed to be reliable. Any opinions, projections or recommendations in this report are subject to change without notice and are not intended as individual investment advice. Not to be used as legal or tax advice. ©2022 Triumphant Portfolio Management, LLC.

The Latest

BLOG POST: Our Current Market Outlook is “Market in a Correction” and our light is “red.“

Where Are Woodward and Bernstein When We Need Them? This article was written by Newt

A poem about a modern day Pig in a Poke, being “woke” and going broke.

Triumphant Truth

You’re not here by accident. God loves you. He wants you to have a personal relationship with Him through Jesus, His Son. Triumphant strives to honor the Lord and bear witness to His love and mercy by serving our clients with disciplined, proactive wealth management.

14803 Forest Rd.

#1147

Forest, VA 24551

Request a Triumphant newsletter to receive updates on the markets and Christ-centered investing.

Send mail to:

14803 Forest Rd. # 1147

Forest, VA 24551

Request a Triumphant Newsletter to receive updates on the markets and Christ-centered investing.

This information is not intended to be a substitute for specific individualized advice. The TPM strategies cannot assure a profit nor protect against loss. Inherent limitations and market conditions may affect the performance of portfolios in any given market environment. Past performance does not guarantee future results. Investors should consider the investment objectives, risks, charges, and expenses associated with any investment strategy.

Advisory Services Through Sowell Management, a Registered Investment Advisor | Privacy & Disclosures | © 2026 Triumphant Portfolio Management, LLC