Current Market Outlook

BLOG POST: Our Current Market Outlook is “Market in an Uptrend” and our light is “green.“

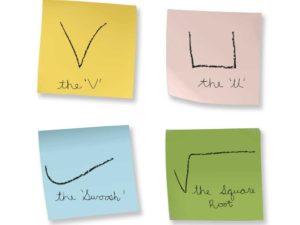

Have you noticed how many experts are trying to define the shape of the expected recovery nowadays. Some say it will be a “U” shaped recovery, while others are expecting more of a “W”. Some pessimists are forecasting a “L” shape, while optimists are hoping for a big “V”. There are even square root sign and Nike swoosh theories. (Image credit: Financial Post)

No matter which outlook is being espoused, no one seems to be expecting a capital “I” (straight down) or a lightning bolt, like what happened in 1929-1932. And that’s good news!

But why is that? Why is there such apparent unanimity in the belief that we will recover, and probably sooner than later?

Answer: Truly historic measures being taken by the Fed, the Treasury Dept, the President’s administration, and Congress to produce numerous stimulus programs for massive & rapid distribution of trillions in cash.

To liken these programs to caffeine or nitrous would be a massive understatement. How about dynamite? Nope. Maybe NASA rocket fuel? Think bigger. Give up? It’s more like a nuclear explosion in our estimation. Let’s call them economic WMC’s: Weapons of Mass Conduction.

According to physics.info, heat conduction is the flow of internal energy (let’s call that money- $) from a region of higher temperature (our Govt) to one of lower temperature (our communities) by the interaction of the adjacent particles (sort of like you & me and our bank accounts) in the intervening space (the economy). Weapons of Mass Conduction: creating energy (activity) in our country internally and staving off a depression.

Judging by the markets big “V” rapid recovery so far, it appears to us that the market is pricing in a Trump victory come November. (It is less than 6 months away and Mr. Market tends to look 6-9 months out into the future.) Maybe that would be the ultimate “V”- victory. There may even be significant “coattails” as a backlash to the shelter-in-place orders from Governors in certain key “lite-blue” states. We will see, but our research shows smart money tends to stay with the incumbent President.

Our Current Market Outlook remains “Market in an Uptrend” with a “green” light. Three of our Core Four indicators are green, while 1 remains yellow, leaving a net green condition. The market appears to be nearing a decision point. The next 2 weeks will likely be very telling.

What can investors consider doing today? Keep your head about you. Tighten stops and take profits in extended positions. Remain diligent with new buys. Go outside, enjoy the weather and exercise. 🙂

Have a Triumphant day! ®

The information in this article is based on data obtained from recognized services and sources and is believed to be reliable. Any opinions, projections or recommendations in this report are subject to change without notice and are not intended as individual investment advice. Not to be used as legal or tax advice. ©2020 Triumphant Portfolio Management, LLC.

The Latest

BLOG POST: Our Current Market Outlook is “Market in an Uptrend” and our light is “green.“

Where Are Woodward and Bernstein When We Need Them? This article was written by Newt

A poem about a modern day Pig in a Poke, being “woke” and going broke.

Triumphant Truth

You’re not here by accident. God loves you. He wants you to have a personal relationship with Him through Jesus, His Son. Triumphant strives to honor the Lord and bear witness to His love and mercy by serving our clients with disciplined, proactive wealth management.

14803 Forest Rd.

#1147

Forest, VA 24551

Request a Triumphant newsletter to receive updates on the markets and Christ-centered investing.

Send mail to:

14803 Forest Rd. # 1147

Forest, VA 24551

Request a Triumphant Newsletter to receive updates on the markets and Christ-centered investing.

This information is not intended to be a substitute for specific individualized advice. The TPM strategies cannot assure a profit nor protect against loss. Inherent limitations and market conditions may affect the performance of portfolios in any given market environment. Past performance does not guarantee future results. Investors should consider the investment objectives, risks, charges, and expenses associated with any investment strategy.

Advisory Services Through Sowell Management, a Registered Investment Advisor | Privacy & Disclosures | © 2025 Triumphant Portfolio Management, LLC