Current Market Outlook

BLOG POST: Our Current Market Outlook is “Market in a Correction” and our light is “red.“

The Current Market Outlook remains “Uptrend Under Pressure” with a “yellow” light. Two of the Core Four indicators are still green reflecting the current major trend, while the other two are yellow and red reflecting the stock markets current hesitancy. (see Core Four above) Please note that this set-up in the Core 4 is still on the verge of going green.

The markets remain bifurcated, except this time we are not discussing the differing directions of the Nasdaq vs. the S&P500. Rather, we are pointing out the differing outlooks being presented by the bond market (growing more worrisome & negative) vs. the “up, up & away” action of the stock market.

These two can’t remain at odds for long. At some point they will agree with each other, but probably not until a major event forces one to join the other. Negatively: The economy worsens and stocks plunge into agreement with the bonds. Positively: The economy bolts ahead and surprises the pundits forcing the bond market to improve its outlook and join the stock market party.

The Nasdaq and growth stocks from many different industries continue to earn investors favor. And why not? Many of them are tackling the tough issues of Covid-19. Fortunately, we discerned many of these emerging trends early in the recovery and have captured nice gains recently.

Areas of strength remain in the health care, technology and precious metals/miners industries. Housing and wood products, internet and e-tailing, and environmentally friendly solar and electric vehicles have also been strong lately. Keep in mind though, true clarity of the next recovery’s long term industry leaders may not come until AFTER the election results are finalized.

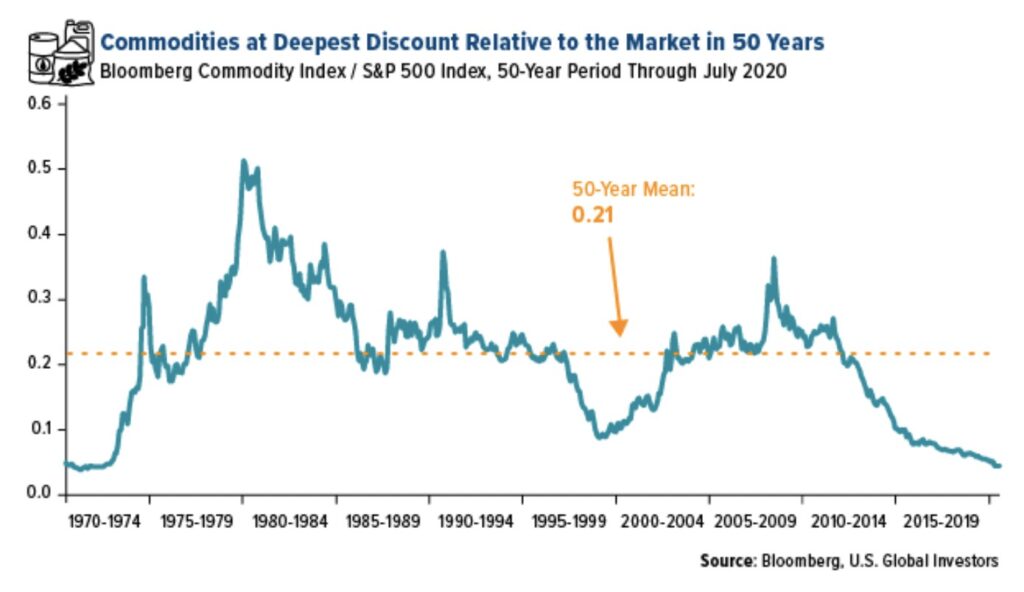

Here’s an interesting chart we ran across recently from Bloomberg, U.S. Global Investors. Very telling on what all this new stimulus may ultimately lead to.

We are not of the opinion that it is a coincidence, or merely as a result of hedging and investor fear, that the price of Gold just hit an ALL-TIME HIGH IN THE HISTORY OF THE WORLD. Our research shows that when Washington hits the panic button during a crisis and “prints new $” the outcome almost always immediately benefits the precious metals complex. Can you imagine what roughly “ten times” (10X) the stimulus amount (from Obama and his team) may look like this time around? (See The Big “V”- WMC’s: weapons of mass conduction, here.)

As a result of this new information, the shares of many precious metal mining companies are acting like growth stocks. This is taking many by surprise; it probably shouldn’t. Many investors have such a disdain for the mining industry that they can’t fathom a renaissance in this area. John Maynard Keynes is credited with saying, “When the facts change, I change my mind. What do you do, sir?”

At Triumphant we pay attention. These trends (changes) can take several months, even quarters, to develop. What are you planning to do?

What can investors do now? Eliminate positions that have not yet participated in the recovery and are showing losses. Start investigating the areas that historically lead as a new business cycle is birthed. Re-visit stops, and remember the necessary technical conditions for a serious correction into a bear market are not currently present.

Have a Triumphant day! ®

The information in this article is based on data obtained from recognized services and sources and is believed to be reliable. Any opinions, projections or recommendations in this report are subject to change without notice and are not intended as individual investment advice. Not to be used as legal or tax advice. ©2020 Triumphant Portfolio Management, LLC.

The Latest

BLOG POST: Our Current Market Outlook is “Market in a Correction” and our light is “red.“

Where Are Woodward and Bernstein When We Need Them? This article was written by Newt

A poem about a modern day Pig in a Poke, being “woke” and going broke.

Triumphant Truth

You’re not here by accident. God loves you. He wants you to have a personal relationship with Him through Jesus, His Son. Triumphant strives to honor the Lord and bear witness to His love and mercy by serving our clients with disciplined, proactive wealth management.

14803 Forest Rd.

#1147

Forest, VA 24551

Request a Triumphant newsletter to receive updates on the markets and Christ-centered investing.

Send mail to:

14803 Forest Rd. # 1147

Forest, VA 24551

Request a Triumphant Newsletter to receive updates on the markets and Christ-centered investing.

This information is not intended to be a substitute for specific individualized advice. The TPM strategies cannot assure a profit nor protect against loss. Inherent limitations and market conditions may affect the performance of portfolios in any given market environment. Past performance does not guarantee future results. Investors should consider the investment objectives, risks, charges, and expenses associated with any investment strategy.

Advisory Services Through Sowell Management, a Registered Investment Advisor | Privacy & Disclosures | © 2026 Triumphant Portfolio Management, LLC